The Market Pulse: UNH Stock in Focus

As the healthcare sector continues to evolve amidst economic uncertainties, UnitedHealth Group Incorporated (UNH) stock has emerged as a focal point for investors. Many are closely watching its performance as it grapples with the dual pressures of regulatory changes and rising healthcare costs. This analysis aims to shed light on the recent trends and what lies ahead for UNH stock.

Recent Performance and Trends

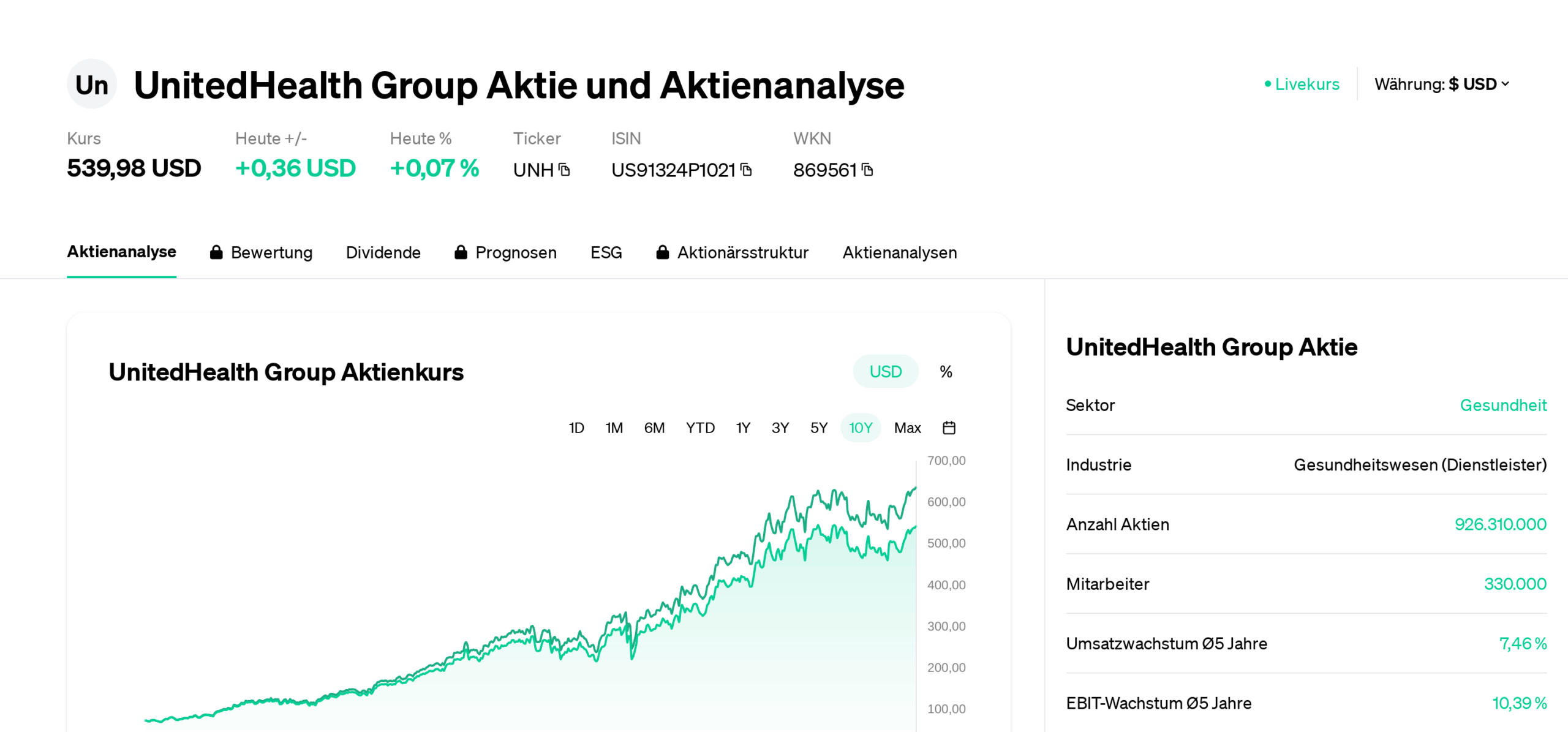

UNH stock has seen fluctuations over the past year, reflecting broader trends in the healthcare industry. While it peaked at $550 earlier this summer, a combination of market volatility and investor concerns regarding federal healthcare policies saw it dipping to approximately $490. As of now, a recovery seems underway, positioning UNH stock at around $515—yet questions about its future remain.

According to data from Yahoo Finance, UNH has reported a year-to-date return of approximately 15%, outperforming many competitors in the insurance and healthcare services sector. This resilience in performance is a testament to the company’s robust business model, including its diversifications within healthcare services, pharmacy benefits, and technology solutions.

Expert Opinion: Is now the time to buy?

Experts are divided on the future of UNH stock. “While the short-term challenges are evident, especially with increasing scrutiny on prescription drug pricing, the long-term outlook for UnitedHealth remains strong due to its comprehensive service offerings and market leadership,” states Dr. Emily Chen, a healthcare market analyst with MedTech Insights. Her insights reflect a cautiously optimistic sentiment among professionals monitoring UNH’s trajectory.

Investor sentiment on social media platforms like Twitter and StockTwits expresses a mix of enthusiasm and caution. Comments indicating trust in UnitedHealth’s leadership and market position are prevalent, though concerns about regulatory impacts are also threaded throughout discussions. The hashtag #UNHStock continues to trend, evidencing active discourse among investors.

Market Dynamics and Future Outlook

The healthcare sector is facing transformative changes, especially with the impending effects of new regulatory policies introduced by the government aimed at drug pricing. Analysts predict that companies with diversified portfolios, like UnitedHealth, could weather these changes more effectively. Furthermore, the company’s investment in technological integration, from telemedicine to data analytics, is expected to drive future growth.

As we approach the end of 2023, many investors are leveraging their portfolios in anticipation of potential market rebounds. UNH remains a blue-chip stock, with a significant moat around its business model, which is appealing to both conservative and aggressive investors. The upcoming earnings report for Q3 2023 could serve as a crucial indicator for those on the fence about investing in UNH stock.

Final Thoughts

In summary, though the healthcare landscape is challenging, UnitedHealth’s strategic positioning, diversified services, and continuous innovation put it in a strong position to navigate upcoming headwinds. As investors weigh their options, UNH stock stands out as a defensive choice that could stabilize portfolios, even amidst uncertainty. The real question remains whether the current price point offers an attractive entry for potential investors looking to capitalize on long-term growth in a resilient market.