Inflation at Record Highs

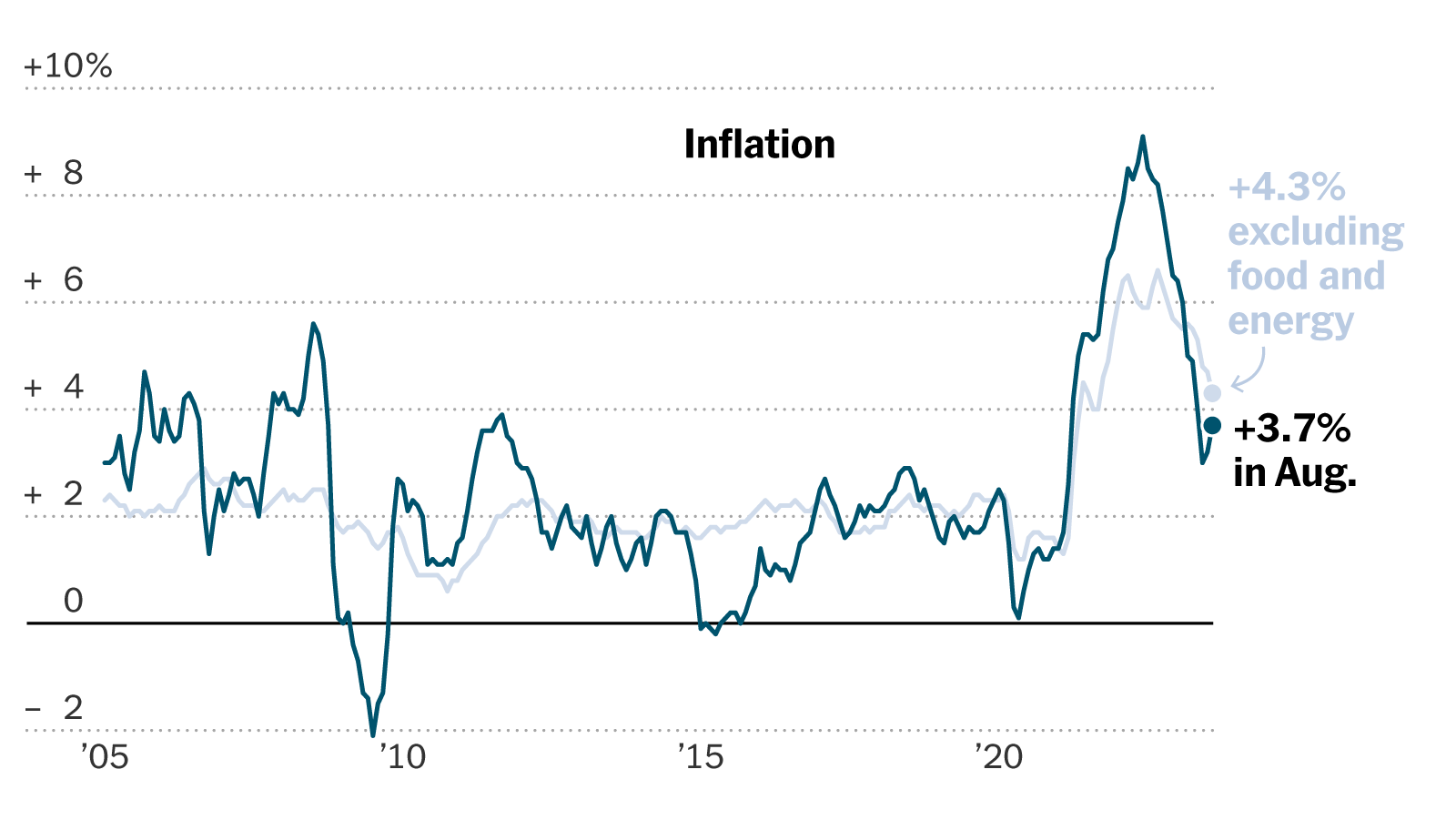

Canadians are feeling the squeeze of rising prices as inflation reaches levels not seen in decades. The latest report from Statistics Canada published this month revealed that the Consumer Price Index (CPI) soared to 6.9% year-over-year in August 2023, prompting widespread concern among citizens and policymakers alike. With essentials like groceries, fuel, and housing costs increasing, many Canadians are worried about their financial stability as the cost of living continues to rise.

Shifting Economic Landscape

This surge in inflation is attributed to multiple factors, including ongoing supply chain disruptions, pandemic-related economic recovery efforts, and geopolitical tensions impacting global markets. In a press conference held last week, Finance Minister Chrystia Freeland stated, “The economic recovery is uneven, and while many sectors are bouncing back, we are also grappling with rising prices that are hitting families hard. We are taking steps to stabilize the economy and protect Canadians at this difficult time.”

Public Reaction

The public’s reaction to these skyrocketing inflation rates has been mixed, with many expressing deep concern over their personal finances. A recent survey conducted by Leger Marketing found that 42% of Canadians rated inflation as their top concern, outpacing issues like climate change and healthcare. Social media platforms have also been flooded with discussions about inflated grocery prices, with hashtags like #InflationFears and #CostOfLivingTrending nationally.

The Impact on Households

The ramifications of rising inflation extend beyond just price tags. Families are now having to make difficult budgetary choices. A mother of three from Toronto, Jessica O’Reilly, shared her thoughts on social media, saying, “It’s heartbreaking to see our grocery bills double in just a few months; I have to think twice about what to put in my cart.” As consumer purchasing power declines, businesses too are bracing for potential changes in spending behavior, which could lead to an overall slowdown in economic growth.

Government Response and Future Outlook

In response to these economic challenges, the Bank of Canada has indicated that it may consider adjusting interest rates to manage inflation. Central Bank Governor Tiff Macklem stated last month, “Balancing growth and controlling inflation is our foremost duty. We will remain vigilant and are prepared to take necessary actions to help ensure price stability for Canadians.” Whether or not these measures will suffice to rein in inflation remains to be seen. Economic analysts believe that external factors, such as fluctuating oil prices and ongoing international trade disputes, will continue to create uncertainty. As the Canadian economy navigates these turbulent waters, many citizens are left wondering what the future holds for their wallets.

Conclusion: A Period of Vigilance

As inflation continues to rise, Canadians remain anxious about the financial burden placed upon them. With increasing energy prices, frequent grocery price hikes, and uncertain economic policies, individuals and families are left to adjust their budgets in a rapidly changing environment. The government’s actions in the coming months will be closely watched, as they work to stabilize prices and provide relief to households feeling the impact of inflation.