A Growing Market Dilemma

The cryptocurrency market has seen its fair share of turbulence in recent years, and as 2023 unfolds, a critical question emerges for investors: should you sell bitcoin? With its price fluctuating wildly amidst tightening regulations and macroeconomic pressures, the sentiment surrounding bitcoin is both cautious and curious.

The Current Bitcoin Landscape

As of mid-2023, the price of bitcoin sits at approximately CAD $50,000. While this is a significant milestone compared to a year ago when it dipped below $30,000, the volatility begs the question for many: is now the time to cash out? According to a recent survey, roughly 48% of bitcoin holders are weighing their options critically: to sell and secure profits or to hold and gamble on further ascension.

Why Some Investors Are Choosing to Sell

A significant driver behind the decision to sell bitcoin stems from concerns about an impending regulatory crackdown. Governments worldwide, particularly in Canada, are ramping up discussions about how to treat cryptocurrencies. “The atmosphere has changed, and many feel the need to liquidate before potentially harsher guidelines are put in place,” explains financial analyst Ethan Reyes. As a precautionary measure, selling bitcoin has become a popular strategy among those wary of future restrictions affecting their investments.

FOMO: Fear of Missing Out vs. Fear of Losing Out

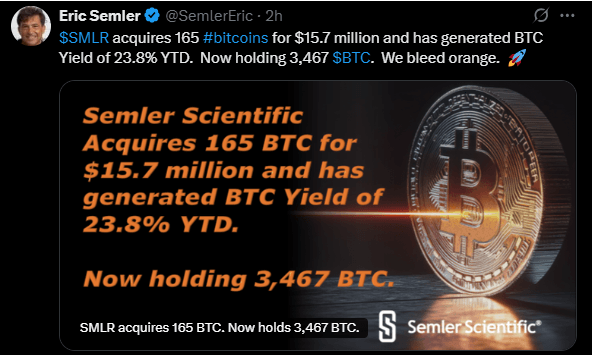

The psychological impact of FOMO (Fear of Missing Out) and FOL (Fear of Losing) is evident in investor behavior. Some bitcoin holders are clutching tightly to their assets, banking on the idea that the cryptocurrency could soar to new heights, especially amid increasing institutional interest. Moreover, major companies are beginning to add bitcoin to their treasuries, creating an atmosphere of legitimacy and potential long-term growth.

Public Sentiment and Social Media Buzz

Social media platforms are buzzing with discussions about whether or not it’s prudent to sell bitcoin. Reddit threads are rife with debates, memes, and opinions, highlighting a divided community. On Twitter, the hashtag #SellBitcoin has sparked vibrant discussions with comments ranging from enthusiasm over potential gains to dire warnings about impending market shifts.

Projected Outcomes and Market Implications

If trends continue, we may see a significant wave of selling in the coming months as investors act on their fears and market predictions. This could lead to a dip in prices that could force others to sell, creating a cascading effect that could destabilize the market further. On the flip side, if positive regulatory frameworks emerge, those who hold onto their bitcoin may stand a chance for substantial rewards in the future.

Final Thoughts

Whether you decide to sell bitcoin or hold onto it depends on your risk tolerance and outlook on the cryptocurrency market. Investors face a fork in the road, where each path presents its own set of potential rewards and pitfalls. As always, doing thorough research and staying updated on market trends and regulations will be essential to making an informed decision.