The Semiconductor Surge

As tech stocks continue to attract attention in an ever-evolving market, NVTS, a prominent player in the semiconductor industry, has captured the interest of investors. With its unique foothold in cutting-edge technologies, including data centers and AI-driven applications, NVTS stock has become a focal point for analysts and shareholders alike. The question on everyone’s mind is whether NVTS can sustain its upward trajectory, or if it will face challenges along the way.

Recent Performance and Market Reactions

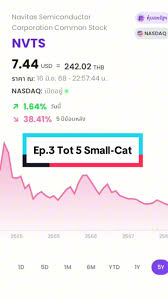

In the last quarter, NVTS stock has demonstrated remarkable resilience, surging nearly 30% amid the rising demand for semiconductor products globally. This impressive performance comes as the industry grapples with supply chain disruptions and heightened demand from various sectors, particularly electric vehicles and AI computing solutions. Social media sentiment on platforms like Twitter and Reddit reflects a cautiously optimistic outlook, with many investors trumpeting the stock as a potential long-term play: “If you’re eyeing the semiconductor sector, NVTS stock is definitely one to watch,” one investor tweeted.

Expert Insights on NVTS’s Future

Industry experts are weighing in on the potential of NVTS stock. Dr. Emily Chang, a financial analyst specializing in technology equities, notes, “NVTS has sustained a competitive advantage through innovation and strategic partnerships. Their recent collaborations with major tech firms hint at robust future growth. However, volatility in the semiconductor market could pose risks, and investors need to remain vigilant.” These sentiments underscore the compelling yet complex nature of investing in NVTS.

The Landscape of the Semiconductor Industry

To fully appreciate NVTS’s trajectory, it’s essential to contextualize the current semiconductor landscape. The global shortage experienced over the past few years has catapulted companies like NVTS into a spotlight that emphasizes both opportunity and risk. As demand for microchips in various applications escalates, businesses are investing heavily in production capabilities. Analysts forecast the semiconductor market will reach USD 560 billion by 2024, driven by an expansion in AI and IoT technologies, which bode well for companies positioned like NVTS.

Potential Challenges Ahead

Despite the promising outlook, NVTS stock is not without its challenges. Increased competition from other semiconductor manufacturers and geopolitical tensions, particularly between the U.S. and China, add layers of complexity that could affect market stability. Furthermore, fluctuating material costs and potential regulations on semiconductor exports may disrupt operations and profitability. “Investors need to remain aware of these variables. While the upside is attractive, unforeseen shocks could shake investor confidence quickly,” cautions Dr. Chang.

What Lies Ahead for NVTS Stock?

As NVTS stock continues to navigate this treacherous yet exciting market, investors are advised to keep a close watch on both the company’s strategic decisions and broader economic indicators. With an eye toward innovation and partnership, NVTS represents an intriguing option for investors looking to capitalize on the semiconductor boom. While risks remain, the potential for significant returns cannot be overlooked. In the end, only time will tell how NVTS stock will fare in an industry marked by rapid evolution and unforeseen challenges.