JPMorgan Chase: A Resilient Player in Financial Markets

As one of the largest and most influential banks in the world, JPMorgan Chase (JPM) has long been a barometer for the financial sector, especially in these fluctuating economic times. After emerging relatively unscathed from the recent economic turmoil, the performance of JPM stock continues to attract attention from both seasoned investors and financial novices. With its diversified portfolio and robust risk management strategies, JPMorgan Chase seems poised to face ongoing challenges head-on.

Market Performance and Recent Trends

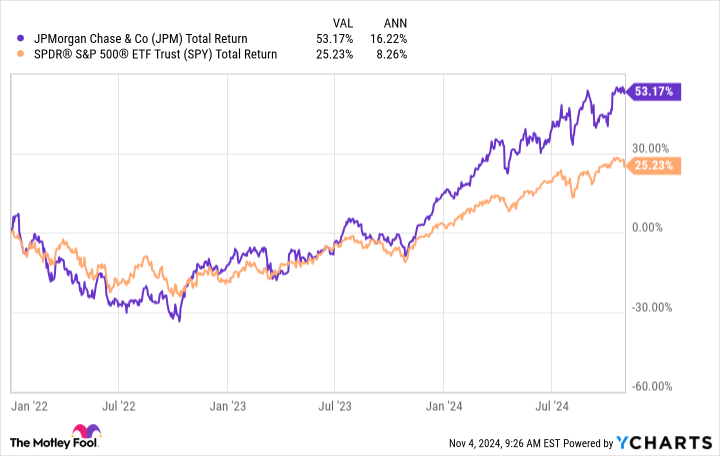

JPM stock has shown resilience over the past year, with its share price consistently hovering around $140, reflecting a modest increase of approximately 15% since the beginning of 2023. Recent reports highlight how JPMorgan’s strong earnings and strategic acquisitions have bolstered investor confidence. A report published by the bank noted that they achieved a record profit in the second quarter of 2023, yielding substantial dividends for shareholders.

“JPMorgan continues to set the bar for bank performance, showcasing strong fundamentals and adaptability in a rapidly changing environment,” said financial analyst Karen Phelps of Mercury Investments. Such sentiments reflect the general optimism surrounding the stock, which many experts believe is indicative of broader confidence in the banking sector.

Expert Insights and Predictions

Despite positioning itself favorably, analysts warn that JPM stock is not without risks. The potential for a recession and interest rate fluctuations may impact the banking sector overall. According to a recent survey conducted by the Bank of Canada, nearly 60% of consumers anticipate rising interest rates by the end of 2024, which could reduce consumer borrowing and spending.

Yet, experts argue that JPMorgan’s diversified operations—from retail banking to investment services—serve as a buffer against economic headwinds. “In a recessionary environment, JPM has the ability to pivot and strategize based on where they see consumer demand evolving, which helps safeguard their bottom line,” remarks investment consultant Richard Ng. This adaptability, coupled with a strong capital position, suggests that even if external conditions worsen, JPM stock may remain relatively stable compared to its peers.

Public Sentiment and Social Media Reaction

Investors have flocked to social media to voice their thoughts on JPM stock, revealing a mixture of optimism and caution. Platforms like Twitter and Reddit have become pivotal for retail investors sharing advice and bets on stock movements. Posts tagged with #JPMSteady have gained traction, demonstrating a grassroots campaign for continued support of JPMorgan’s stock. Comments highlight a blend of fear regarding economic downturns, balanced by an unwavering faith in JPM’s leadership and market strategies.

The Road Ahead

As we look to the future, it’s clear that JPM stock is set against a backdrop of both opportunity and risk. Strategic financial maneuvers, a strong balance sheet, and a proven management team position the bank well for varying market conditions. Observers will undoubtedly be eager to see how JPMorgan navigates potential economic pitfalls while leveraging its extensive resources for growth.

For investors, understanding not only the historical performance of JPM stock but also the broader economic signals will be crucial in the coming months. With anticipation building around quarterly earnings and external macroeconomic trends, the outlook remains promising but full of cautionary tales about the global financial landscape.