Investors Rush to Buy GME Stock as Volatility Strikes

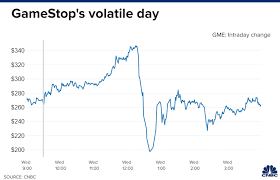

In a stunning twist in the realm of stock market trading, GME stock has experienced an unprecedented surge, gaining over 40% in just a single day. As of midday trading on Wednesday, shares of GameStop were priced at $180, marking a dramatic rebound from recent lows that had investors and analysts questioning the company’s market viability.

What’s Behind the Surge?

The sudden spike can largely be attributed to a renewed wave of enthusiasm among retail investors, particularly those operating within the Reddit community, which played a pivotal role in the earlier surge of GME stock in early 2021. As major indices continued to wobble amidst rising interest rates and concerns over inflation, GME stock became a beacon of hope for many small-time investors looking to capitalize on the volatility.

A statement from one anonymous retail investor captured the sentiment: “There’s a rebellious spirit in this surge. It’s not just about making money; it’s about standing against Wall Street’s big players. We’re taking control of our investments, and GME is our battle cry.”

The Broader Market Context

This year has been marked by extreme turbulence in the stock market, with the S&P 500 and Nasdaq Composite both facing downward pressure as economic indicators shift. The tech-heavy Nasdaq has seen losses upwards of 20% since its peak, leading investors to scramble for alternative investment opportunities.

Social media sentiment regarding GME stock has been overwhelmingly positive, with the hashtag #GME trending on Twitter as thousands share their bullish predictions. According to data from sentiment analysis platform Swaggy Stocks, positive sentiment around GME has risen to over 76% in the last three days, up from 48% earlier this month, indicating strong investor enthusiasm.

Analysts Weigh In

While astute investors are taking advantage of the recent volatility, financial analysts are divided over the potential for GME to maintain its momentum. “GameStop’s business model is still operating in a challenging environment, but the retail investor enthusiasm could give it some breathing room in the short term,” said financial analyst Marie T. Wu. “However, we must remain cautious – the fundamentals can’t support endless price increases.”

Future Outlook for GME Stock

As excitement builds around GME, it’s uncertain whether this upswing is sustainable or merely a fleeting moment of euphoria in the chaotic dynamics of the stock market. Many retail investors remain hopeful, with forums buzzing with discussions of price predictions that soar into the hundreds. Others are starting to ponder the implications if this latest chapter results in another round of significant losses down the line.

Investors will be closely watching both the performance of GME as well as economic developments affecting the broader market. If the stock continues to climb, it could signal a broader shift in how retail investors view their role within the financial ecosystem.